One of the most significant advantages of implementing machine learning (ML) and AI solutions for finance operations is the ability to automate decision-making processes. This approach enables BFSI institutions to employ AI for financial analysis, processing customer data and identifying patterns that empower them to tailor their products and services to meet individual needs.

These insights provide your customers with a personalized experience, boosting their satisfaction and loyalty. Moreover, the benefits of AI in banking extend far beyond that, with the potential value generated by using such kinds of digital solutions estimated to exceed $250 billion, according to McKinsey.

Mastering AI and machine learning for finance-related operations also empowers you to identify potential cross-selling opportunities. For instance, if you have a customer with a mortgage, using finance analysis AI tools, you can analyze their spending patterns to assess eligibility for a credit card or a personal loan. This benefits your institution by expanding opportunities and providing your customers with relevant and valuable information.

So, how does using this technology in the financial industry improve your company's processes? Let’s explore how to use AI in finance efficiently, reaping all the benefits and overcoming all the challenges along the way.

The benefits of AI in banking

When it comes to driving innovation through IT in the financial services industry, AI and banking go hand in hand on a daily basis, even while we drink our coffee or visit gyms. Their collaboration empowers businesses to make data-driven decisions quickly and efficiently, gaining that competitive edge essential for successful growth in the highly dynamic market. Here is how leveraging AI and fintech can help you revolutionize the BFSI sector and seize the power of automation for your business.

Improving risk management by employing AI for financial analysis

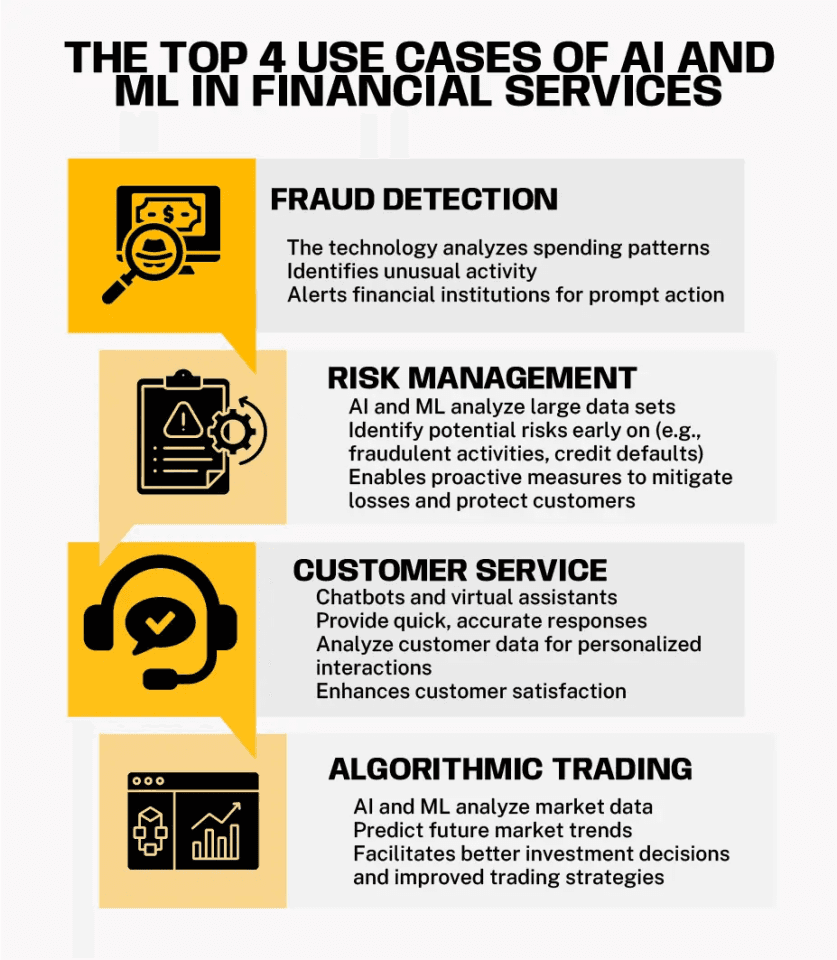

Opting for artificial intelligence in fintech tools enables financial institutions to significantly enhance their risk management frameworks. By analyzing massive big data sets, you can identify potential risks, such as fraudulent activities and credit defaults. This way, you'll be able to mitigate potential losses and protect your customers proactively.

You can easily detect real-time fraud, such as credit card manipulations and money laundering, using powerful ML algorithms and small or large language models. By automatically processing spending patterns, robust platforms that utilize AI for financial analysis will quickly identify suspicious activities and instantly alert your organization, allowing you to respond in real time. Moreover, advanced digital solutions, built by experts who know how to integrate AI in banking and finance, can identify individuals at risk of defaulting on their loans, enabling your employees to take proactive measures to assist them.

In addition to accelerating business decisions, another crucial one, among all AI use cases in banking, is detecting and preventing cyber threats. The World Economic Forum’s research stated that 77 percent of founders believe AI-enabled blockchain solutions will be essential to their operations shortly, indicating that these technologies will continue to transform the BFSI landscape. Hence, following the trends related to the usage of IT in the finance industry is paramount for companies that want to stay ahead of their competitors as the sector evolves rapidly. Such capabilities are essential for BFSI firms to remain resilient and offer better, more modern services to their customers.

Enhancing customer service with generative AI in banking apps

When developing solutions powered by AI for finance and accounting daily operations, you should ensure scalable customer service via automated systems that continually learn and improve over time. Furthermore, you can easily incorporate chatbots and voice assistants that run on small and large language models to automate customer service tasks. By minimizing disruptions in the user's journey through intelligent automation, your brand can decrease acquisition costs and enhance customer-centric metrics.

Trending AI use cases in financial services also include handling help desk inquiries. Here, artificial tools can cleverly route requests based on content, bypassing traditional ticket gatekeepers. Instead, leveraging AI for financial analysis tasks, they can deliver relevant answers to customers’ inquiries in real time or efficiently direct those requests to appropriate departments.

Employing generative AI in banking also enhances customer service in the BFSI industry. This powerful technology analyzes customer data and learns from it, providing personalized, quick, and accurate responses that increase customer satisfaction.

For instance, you can program a chatbot to answer common queries, such as account balances, mortgage eligibility chances, or transaction history. If a customer has a more complex query, a chatbot can transfer the query to a human agent, who will provide a more detailed response. This ensures your customers receive the information they need quickly and efficiently, and your employees focus solely on high-level business activities.

Challenges you might face in implementing AI solutions for finance and banking

While all those benefits of AI in banking are appealing and advantageous, AI solutions for finance also come with challenges that industry institutions must overcome on their way to successful digital business transformation. Some of these challenges include:

Algorithmic Bias: Experts frequently discuss this issue these days, particularly in the context of using AI for financial analysis. If the data used to train the algorithms is biased, this can lead to emotional decision-making processes. For example, if a bank's loan approval algorithm is trained on historical data that contains bias against certain demographic groups, it may perpetuate that bias, resulting in unfair loan decisions. So, your organization has to ensure its algorithms are trained on diverse and representative datasets to eliminate bias when employing AI in accounting and finance operations.

Transparency: When it comes to AI and fintech, financial services providers must also implement transparent and explainable algorithms so customers can understand how their data is used, stored, and processed. This is particularly important in cases when algorithms make decisions that affect customers' lives, such as credit approvals or displaced fraudulent activities. Your customers have a legal right to know how you use algorithms in decision-making.

Data Security: This is one of the most significant challenges of using AI in investment banking and financial services. BFSI companies must ensure that the data they collect and analyze is stored securely and that the algorithms driven by AI for financial analysis do not introduce any vulnerabilities that cybercriminals could exploit. Banking institutions have to guarantee that customer data is anonymized and protected to prevent unauthorized access.

The future of AI in finance and banking

The currently successful use cases of machine learning and artificial intelligence in fintech are essential pioneers in shaping the future landscape of BFSI service models. For instance, JPMorgan Chase has already adopted AI solutions for finance-related workflows, including its virtual assistant COiN, which utilizes natural language processing for lawyers to analyze legal documents. The company also applies these technologies to monitor financial transactions, handle AML, and quickly detect fraud.

The transformative impact of these tools extends beyond current functionalities, promising better decision-making capabilities, the establishment of fairer systems, and notable improvements in efficiency and accuracy. The future of AI and banking is unfolding before us, and the integration of machines is no longer a distant prospect but a present reality.

The undeniable benefits of AI in banking are evident in its capacity to automate manual-heavy processes, enhance customer service, and redefine risk management strategies. However, this transformative journey comes with its set of challenges. Institutions must navigate concerns such as data security, algorithmic bias, and transparency to fully capitalize on the potential pros, avoiding cons. However, by incorporating the necessary precautions and staying vigilant, financial organizations can confidently embrace the power of ML and AI in finance and accounting, propelling their services to the next level of innovation.

With 20+ years of experience in building digital transformation solutions and crafting tools that employ AI for financial analysis, TEAM International is a reputable tech partner that can help you navigate the journey of integrating machine learning and artificial intelligence in fintech software. We address the challenges mentioned above head-on, enabling our customers to harness the full potential of these technologies in their financial businesses.

So, TEAM’s commitment lies in providing solutions tailored to your unique needs while ensuring you stay at the forefront of financial industry trends. We’re ready to transform your business with the best automation practices and unique AI solutions for finance processing goals.